In Power BI, creating optimized data models is crucial for ensuring fast, responsive reports and dashboards. Poorly designed models can lead to slow performance and frustrating user experiences. This blog post will guide you through optimizing your data models for performance, with a focus on using calculated columns and measures efficiently in a financial report.

Why Optimization Matters in Power BI

Optimizing data models enhances performance, ensuring that reports load quickly and calculations are executed efficiently. This is especially important in financial reports, where complex calculations and large datasets are common.

Key Concepts: Calculated Columns vs. Measures

Calculated Columns

Calculated columns are computed during data refresh and stored in the data model. They use row-by-row operations and are useful for adding new data fields based on existing columns.

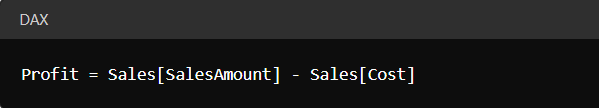

Example: In a financial report, you might create a calculated column for profit:

Profit = Sales[SalesAmount] – Sales[Cost]

Measures

Measures are calculated on the fly during report viewing and are used for aggregations. They use DAX and provide more flexibility and efficiency, especially for large datasets.

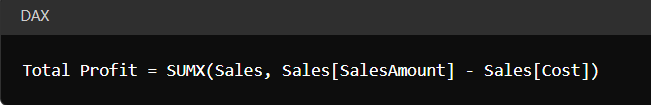

Example: A measure for total profit in a financial report could be:

Total Profit = SUMX(Sales, Sales[SalesAmount] – Sales[Cost])

Steps to Optimize Data Models in Power BI

1. Use Measures Over Calculated Columns

Measures are generally more efficient than calculated columns because they are computed at query time and do not increase the size of the data model. In financial reports, prefer measures for aggregations and calculations.

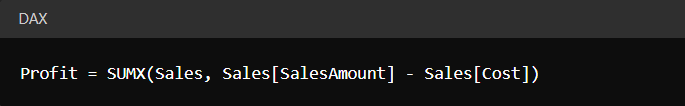

Example: Instead of a calculated column for profit, use a measure:

Profit = SUMX(Sales, Sales[SalesAmount] – Sales[Cost])

2. Reduce Data Model Size

Minimize the size of your data model by:

- Removing unnecessary columns and tables.

- Using appropriate data types.

- Filtering data during import to include only relevant data.

3. Optimize Relationships and Joins

Ensure relationships between tables are correctly defined. Use star schema design to simplify relationships and improve performance.

4. Use Variables in DAX

Using variables in DAX can improve readability and performance by reducing the number of calculations.

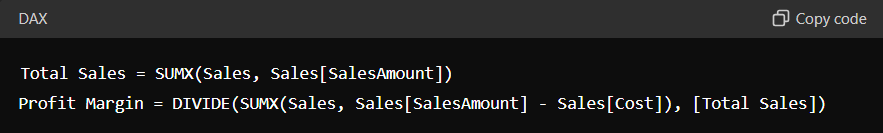

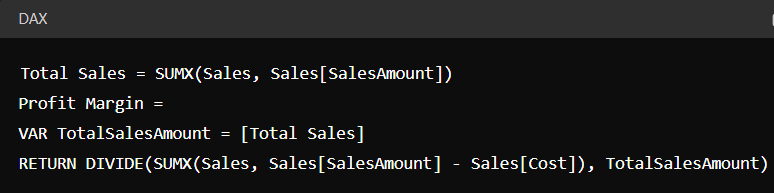

Example: Instead of:

Total Sales = SUMX(Sales, Sales[SalesAmount])

Profit Margin = DIVIDE(SUMX(Sales, Sales[SalesAmount] – Sales[Cost]), [Total Sales])

Use:

Total Sales = SUMX(Sales, Sales[SalesAmount])

Profit Margin =

VAR TotalSalesAmount = [Total Sales]

RETURN DIVIDE(SUMX(Sales, Sales[SalesAmount] – Sales[Cost]), TotalSalesAmount)

5. Aggregate Data

Pre-aggregate data where possible. Instead of detailed transaction-level data, use summarized data to improve performance.

6. Monitor Performance

Use Power BI’s performance analyzer to identify and address performance bottlenecks. Regularly review and optimize your data model based on usage patterns.

Practical Example: Financial Report Optimization

Scenario:

You are building a financial report that includes sales, cost, and profit analysis. The dataset is large, and performance is critical.

Steps:

1.Import Data Efficiently:

- filter unnecessary data during import.

- Select only required columns.

2. Define Relationships:

- Use star schema with Sales fact table and Product, Date, and Region dimension tables.

3. Create Measures:

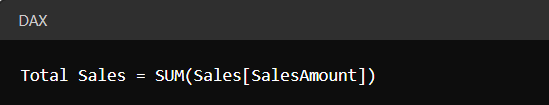

Total Sales:

Total Sales = SUM(Sales[SalesAmount])

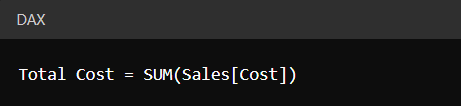

Total Cost:

Total Cost = SUM(Sales[Cost])

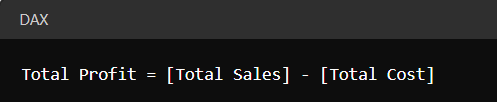

Total Profit:

Total Profit = [Total Sales] – [Total Cost]

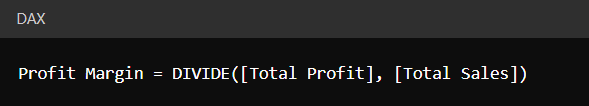

Profit Margin:

Profit Margin = DIVIDE([Total Profit], [Total Sales])

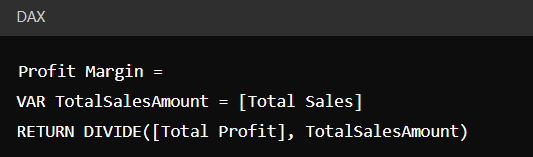

4. Use Variables in Measures:

Profit Margin =

VAR TotalSalesAmount = [Total Sales]

RETURN DIVIDE([Total Profit], TotalSalesAmount)

5. Monitor and Adjust:

- Use Performance Analyzer to identify slow queries.

- Optimize DAX formulas and data model as needed.

Conclusion

Optimizing data models in Power BI is essential for creating responsive and efficient reports. By using measures instead of calculated columns, reducing model size, optimizing relationships, and leveraging DAX variables, you can significantly improve performance. Apply these techniques to your financial reports to ensure fast, accurate, and insightful data analysis.